In 2024, virtual cards have evolved beyond just being a tool for businesses. They are now a convenient solution for anyone who values flexibility and security in managing their finances. Virtual cards have become especially popular among travelers, online shoppers, and users of international services. These cards protect your funds and help you save on fees. The Ultima card from PSTNET combines all the benefits of virtual cards with cutting-edge security technology. It has no spending or top-up limits, and it works everywhere Visa and Mastercard are accepted.

Virtual cards are perfect for paying for a wide range of goods and services. PSTNET offers virtual dollar payment cards that are compatible with international payment systems like Visa and Mastercard.

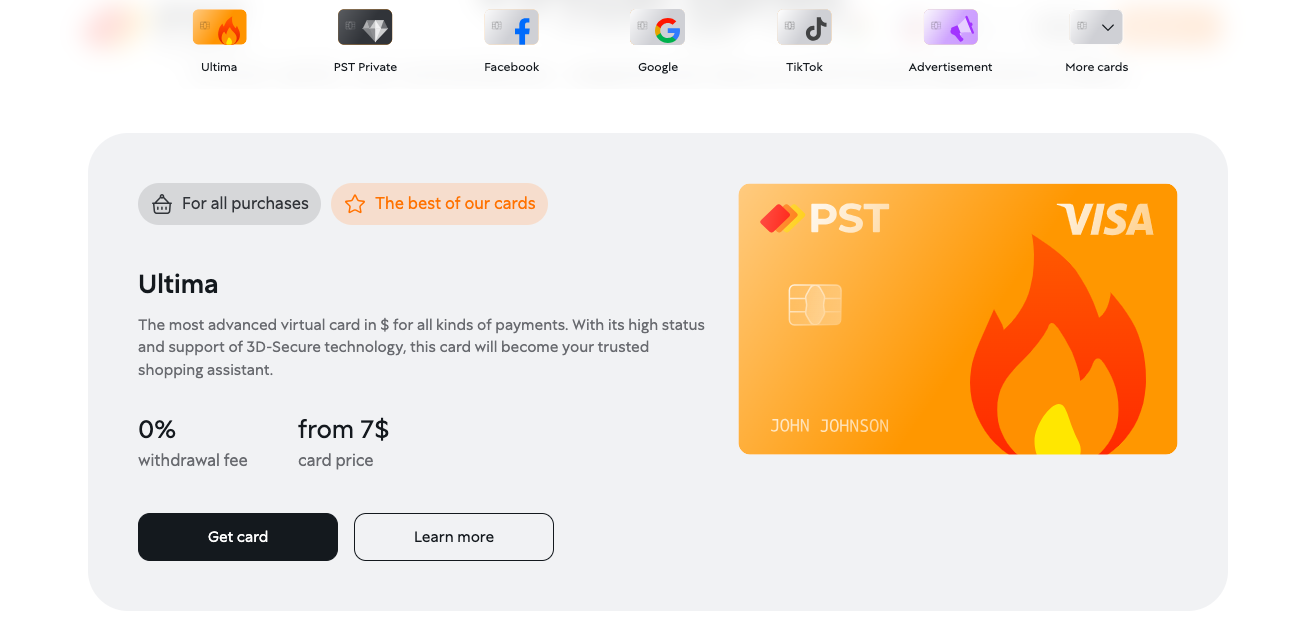

One of their standout offerings is the Ultima card, which comes with no limits on spending or top-ups. You can use Ultima as a versatile solution for any international transaction, from booking hotels to buying digital products and online shopping.

In addition to personal use cards, PSTNET also provides virtual cards for ad payments. These cards are compatible with most popular ad platforms, making them a useful tool for marketers.

All PST.NET cards come equipped with the latest 3D Secure technology, ensuring the security of your financial transactions.

Advantages of the Ultima Card

The Ultima card from PSTNET can be issued in any quantity. For instance, you can create separate cards for different purposes: one for paying for digital subscriptions, another for booking hotels, and a third for shopping. Having multiple cards allows users to better manage their finances and allocate their budget.

- No Limits or Restrictions:

The Ultima card has no spending or top-up limits. Additionally, for active users who make frequent purchases, PSTNET offers the opportunity to receive free cards if you meet the monthly spending requirement.

- Balance Top-Up and Fund Withdrawal:

To add funds to your Ultima card, besides USDT TRC-20/BTC, you can use 16 other popular crypto coins. You can also top up via SEPA/SWIFT bank transfers or other Visa/MasterCard cards. The top-up fee is only 2%.

Funds can be withdrawn in USDT with a 0% fee.

- Card Issuance and Platform Interaction:

To get your first Ultima card, you need to sign up on the PSTNET platform. You can register using your Google, Telegram, WhatsApp, Apple ID, or email account. After registering, you’ll instantly have access to your personal account, where you can issue the Ultima card with just one click.

The card will be immediately available for use, and you can start topping up your balance.

- Telegram bot:

For service notifications and 3D Secure codes.

- Customer support:

24/7 assistance via Telegram chat and other communication channels.

Saving: How Virtual Cards Help You Spend Less on Transactions

In today’s digital world, virtual cards are a perfect fit. Streaming services, online games, and deliveries all require quick and secure payments, and virtual cards make that possible.

International transfers and purchases often come with high fees and hidden charges. Virtual cards help reduce these costs. Thanks to favorable exchange rates and transparent terms, they are a better alternative to traditional cards.

With a virtual card, you can easily manage your finances through your smartphone. It’s a convenient solution for those who frequently use online services and need a universal tool for international payments.

Say goodbye to unnecessary fees on international transactions with the Ultima virtual card!