- Budgeting for restaurant equipment ensures financial stability, prevents unplanned expenses, and maximizes long-term profitability.

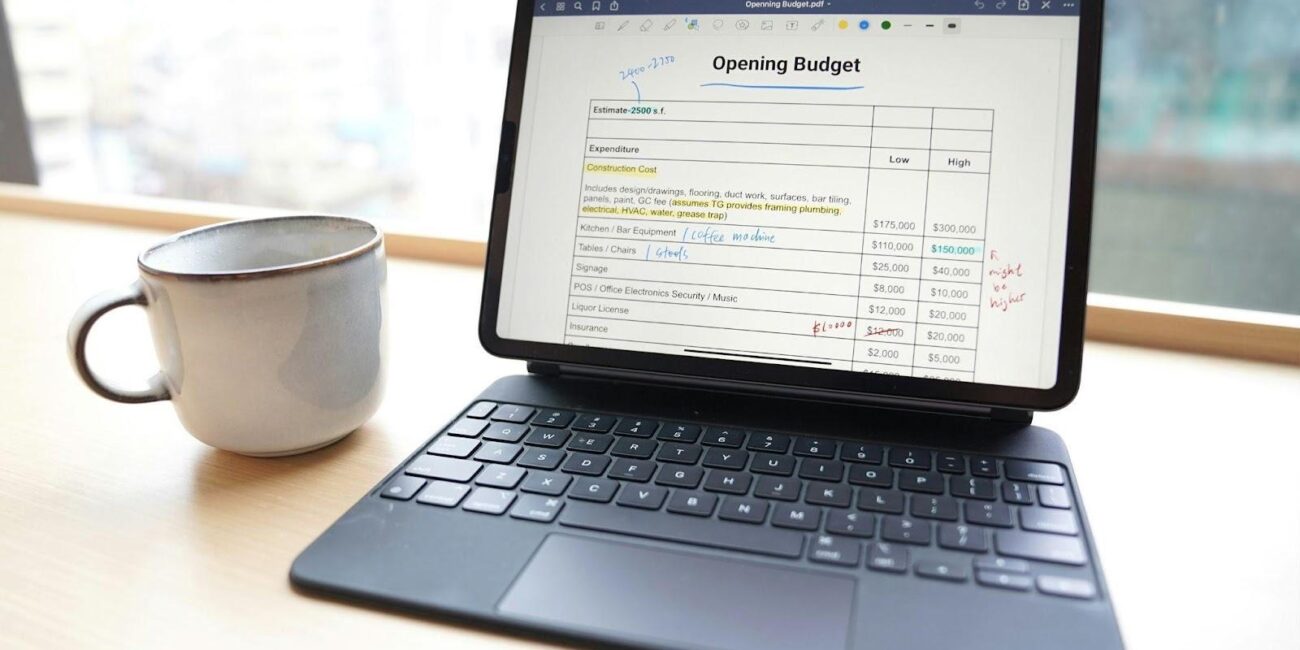

- Tools like calculators and apps can streamline budgeting, helping you make informed financial decisions with precision.

- Building an effective budget involves prioritizing essential equipment, researching costs, and setting realistic financial goals.

- Integrating your equipment budget into overall financial planning ensures alignment with business goals, flexibility, and sustainable growth.

Running a restaurant is no small feat, and one of the trickiest aspects can be managing the budget for your equipment. From ovens to freezers, the costs add up quickly, and without a solid plan, it’s easy to overspend or get overwhelmed. But don’t worry—you’re not alone in this challenge. This blog will walk you through practical steps to simplify your equipment budgeting process. By the end, you’ll understand how to plan effectively, avoid common financial pitfalls, and even use a tool that makes crunching numbers a breeze. Ready to take the stress out of equipment budgeting? Let’s dive in!

Why Restaurant Equipment Budgeting Matters

Budgeting for restaurant equipment might not be the most glamorous task, but it’s essential for running a successful business. Efficient budgeting ensures you’re not just spending money but investing it in tools that will drive your restaurant’s operations. When budgeting is done right, it prevents unexpected financial strain. Unplanned purchases, like replacing a broken piece of equipment at the last minute, can derail your financial stability. Planning ahead means you’re prepared for such scenarios without scrambling for funds. Over time, smart equipment budgeting has a direct impact on profitability. You’re not just saving money upfront—you’re also maximizing the lifespan and efficiency of your equipment. This means fewer breakdowns, smoother operations, and better returns on your investment.

Tools to Simplify Your Budgeting Process

When it comes to restaurant equipment, having the right tools for budgeting can make all the difference. From spreadsheets to apps, there are many resources to streamline your process and help you avoid errors.

One of the most effective tools you can use is an equipment finance calculator. These calculators allow you to estimate costs precisely, factoring in expenses like interest rates, monthly payments, and total equipment costs. With this level of clarity, you can make better-informed decisions about what your budget can accommodate. To make the most of these tools, start by inputting realistic data about your equipment needs. Compare various scenarios—leasing versus purchasing, for example—to see which aligns best with your financial goals. The clearer your numbers, the less likely you are to encounter surprises.

Steps to Build an Effective Equipment Budget

Creating a solid equipment budget starts with understanding your restaurant’s unique needs. Begin by making a comprehensive list of the equipment you require to operate efficiently. Separate the items into two categories: essentials, like ovens and refrigerators, and non-essentials, such as specialty machines you might add later. Next, research the costs for each item on your list. Look into both new and refurbished options, and don’t forget to account for delivery and installation fees. This step will help you prioritize spending on what truly matters. Finally, set realistic financial goals and timelines for acquiring the equipment. For instance, if your budget is tight, you might decide to lease high-cost items in the short term and plan for purchases down the road. The key is to create a budget that balances current needs with long-term growth.

When pricing essentials, don’t forget sinks—they’re compliance-critical and vary widely by configuration. For spec comparisons and price benchmarks, browse the commercial sink selection at Restaurant Supply to review hand, utility, and three-compartment options, then plug those figures (plus faucets and accessories) into your lease-vs-buy scenarios.

Avoiding Common Mistakes in Equipment Financing

Even with the best intentions, budgeting mistakes can happen. One common error is underestimating the full cost of equipment. Beyond the purchase price, there are maintenance, warranties, and eventual replacement costs to consider. Failing to factor these in can lead to unexpected expenses. On the other hand, overestimating your budget can result in wasted resources. Spending more than necessary on top-of-the-line equipment that isn’t essential for your operations can strain your finances unnecessarily.

Focus on quality and reliability over luxury features you might not need. Another pitfall is working with unreliable suppliers or lenders. Always vet your vendors thoroughly. Check reviews, ask for recommendations, and ensure you understand all terms and conditions of financing agreements. A little due diligence can save you from costly headaches down the line.

Integrating Your Equipment Budget with Overall Financial Planning

An equipment budget isn’t just a standalone document—it’s a vital part of your restaurant’s overall financial strategy. To make the most of it, ensure that your equipment budget aligns with your broader business goals. For example, if you’re planning to expand your menu, your equipment purchases should support that growth. Tracking and adjusting your budget over time is another crucial step. Costs and priorities can shift as your business evolves, so revisit your budget regularly to ensure it still meets your needs. A flexible approach will help you stay on top of your finances without sacrificing quality or efficiency. Finally, balance growth with sustainability. While it’s tempting to invest heavily in the best equipment, remember to allocate funds for other aspects of your business, like marketing or staff training. A holistic view of your financial planning ensures long-term stability.

Conclusion

Budgeting for restaurant equipment doesn’t have to be a daunting task. By planning ahead, using the right tools, and avoiding common mistakes, you can create a financial strategy that supports your restaurant’s success. When your equipment budget is aligned with your broader goals, you gain not only peace of mind but also the freedom to focus on what truly matters—serving great food and delivering exceptional customer experiences. Now is the perfect time to take control of your equipment planning and set your business up for a prosperous future.