In today’s digital age, managing our finances has become increasingly convenient with the rise of personal finance tracking apps. These apps promise to simplify budgeting, track expenses, and provide insights into our spending habits. However, as with any technology that handles sensitive financial information, concerns about data privacy and security inevitably arise. Is it truly safe to entrust our financial details to these apps, or are we putting ourselves at risk?

The Allure of Finance Tracking Apps

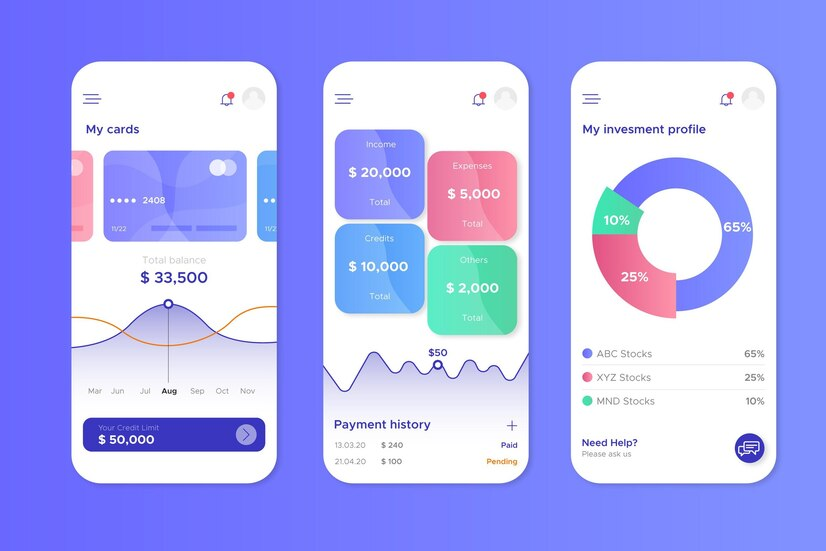

Personal finance apps have gained immense popularity due to their user-friendly interfaces and wide range of features. These apps offer a comprehensive solution for managing our financial lives, from monitoring bank account balances and categorizing expenses to setting savings goals and creating detailed budgets.

One of the most significant advantages of these apps is their ability to provide real-time insights into our spending patterns. By automatically categorizing transactions and presenting them in visually appealing charts and graphs, users can quickly identify areas where they may be overspending and make informed decisions to curb unnecessary expenses.

Moreover, many finance tracking apps integrate with various financial institutions, enabling seamless synchronization of bank account and credit card data. This eliminates the need for manual data entry, making maintaining an accurate and up-to-date financial picture easier.

The Privacy Conundrum

While the convenience of finance tracking apps is undeniable, their reliance on sensitive personal and financial data raises legitimate privacy concerns. When we grant these apps access to our bank accounts, credit card information, and other financial details, we’re essentially entrusting them with some of our most confidential information.

One of the primary risks associated with finance tracking apps is the potential for data breaches. In recent years, numerous high-profile companies have fallen victim to cyber-attacks, compromising the personal information of millions of users. If a finance tracking app were to experience a similar breach, the consequences could be devastating, potentially exposing users to identity theft, fraud, and financial loss.

Additionally, some users may be uncomfortable with the idea of a third-party app having access to their financial data, even if the app claims to employ robust security measures. There’s always a lingering fear that this information could be misused or sold to advertisers or other entities without the user’s explicit consent.

Finding the Right Balance

Despite the valid data privacy concerns, it’s important to recognize that many reputable finance tracking apps prioritize security and take proactive measures to protect their users’ information. These measures may include end-to-end encryption, multi-factor authentication, and strict data handling policies.

Ultimately, the decision to use a finance tracking app for personal budgeting comes down to weighing the potential risks against the benefits and convenience these apps provide. For individuals who prioritize privacy and have concerns about data security, manually tracking expenses and budgeting using spreadsheets or traditional methods may be a more suitable option.

However, for those comfortable with the inherent risks and taking proactive steps to safeguard their information, such as using strong passwords, enabling two-factor authentication, and regularly monitoring their accounts for suspicious activity, finance tracking apps can be a powerful tool for gaining control over their finances.

Take Control of Your Financial Future

Regardless of the approach you choose, taking an active role in managing your finances is crucial for achieving financial stability and reaching your long-term goals. Whether you opt for a digital solution like a finance tracking app or prefer a more traditional method, the key is to develop a consistent budgeting routine and monitor your spending habits. This will help you identify areas where you can cut back and free up more money to save towards your goals, even if you occasionally need to resort to using lenders like CreditNinja loans in an emergency.

By embracing financial literacy and adopting responsible money management practices, you can navigate the digital dilemma and make informed decisions that align with your priorities and risk tolerance.

Conclusion

The digital dilemma surrounding finance tracking apps for personal budgeting is complex and involves valid concerns on both sides. While these apps offer convenience and valuable insights, they also introduce potential privacy and security risks.

Ultimately, the decision to use a finance tracking app should be based on a careful evaluation of your circumstances, comfort level with sharing financial data, and the measures taken by the app provider to protect user information.

By staying informed, practicing caution, and prioritizing financial literacy, you can navigate the digital landscape and take control of your financial future, whether you embrace the convenience of finance tracking apps or opt for more traditional budgeting methods.

Regardless of the approach you choose, the most important step is to actively engage with your personal finances and cultivate healthy money management habits that will serve you well in the long run.